Current Ratio Less Than 1

Will be updated into the Nevada Accountability Portal. 95 th percentile less than limits Future of IEEE 519 Interharmonics Below 120 Hz.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)

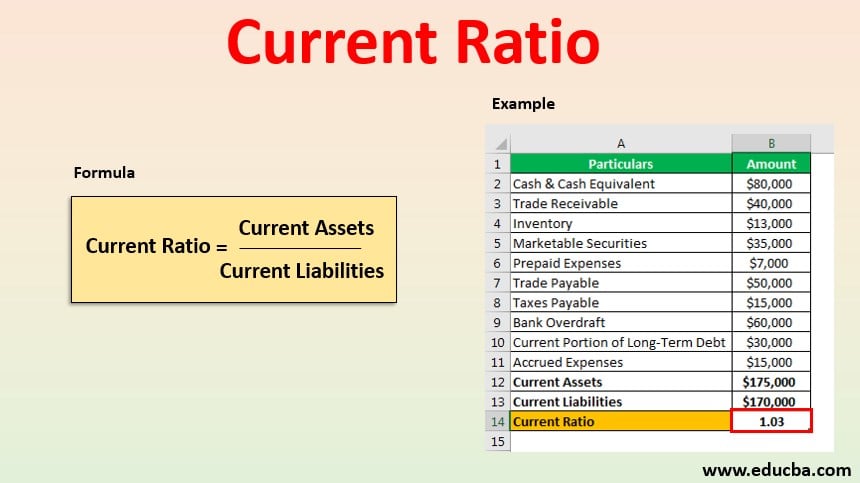

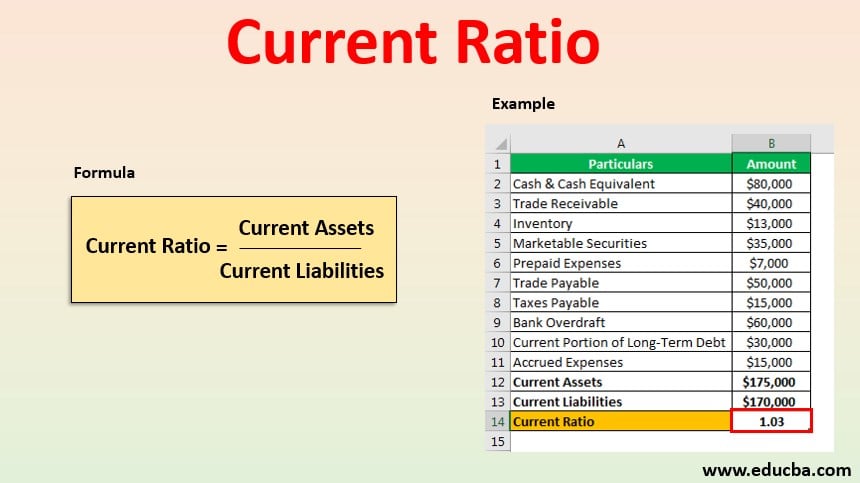

Current Ratio Explained With Formula And Examples

A ratio higher than one means that current assets if they can all be converted to cash are more than sufficient to pay off current obligations.

. The Current Ratio formula is Current Assets Current Liabilities. Interpretation of Current Ratios. Step-down transformer steps voltage down and current up.

The current ratio also known as the working capital ratio measures the capability of a business to meet its short-term obligations that are due within a year. Maximum demand current 15 or 30 minute demand not momentary. Typical ETF expense ratios are less than 1.

99 th percentile less than 15 times limits Current. Liquidity ratios greater than 1 indicate that the company is in good financial health and it is less likely fall into financial difficulties. If Current Assets Current Liabilities then Ratio is less than 10 - a problem situation at hand as the.

For most industrial companies 15 may be an acceptable current ratio. The current ratio is a liquidity ratio that measures a companys ability to pay short-term and long-term obligations. How the ETF expense ratio works.

While the number of candidates qualified to the mains exam is approximately 14 times the number of vacancies which shows approximately 15008 cleared the prelims exam. Then greenhouse gas emissions took a downward turn. Three-phase fault current IL.

Non-occupant borrowers the maximum ratio is lower than 45 for the occupying borrower for manually underwritten loans see B2-2-04 Guarantors Co-Signers or Non-Occupant Borrowers on the Subject Transaction. Government mortgage loans lenders must follow the requirements for the respective government agency. To gauge this ability the current ratio considers the current.

A current ratio of less than 1 indicates that the company may have problems meeting its short-term obligations. It indicates the financial health of a company. How does Statutory Liquidity Ratio work.

If Current Assets Current Liabilities then Ratio is greater than 10 - a desirable situation to be in. Acceptable current ratios vary from industry to industry. A large cohort study found that using the GOLD criteria FEV 1 FVC less than 70 for diagnosis of chronic obstructive pulmonary disease COPD in US.

SLR or Statutory Liquidity Ratio is the percentage of a banks net demand and time liabilities that the bank needs to maintain in the form of liquid assets. Lets say you invest 100000. All other things equal higher values of this ratio imply that a firm is more easily able to meet its obligations in the coming year.

The ratio considers the weight of total current assets versus total current liabilities. If inventory turns into cash much more rapidly than the accounts payable become due then the firms current ratio can comfortably remain less than one. However an investor should also take note of a companys operating cash flow in order to get.

Know about SLR objective components. If Current Assets Current Liabilities then Ratio is equal to 10 - Current Assets are just enough to pay down the short term obligations. The amount emitted in 2017 was less than that in 2010 the year before the Earthquake.

ISC I L Ratio ISC. That means that for every 1000 you invest you pay less than 10 a year in expenses. Some types of businesses can operate with a current ratio of less than one however.

NSPF school ratings and accountability indicators will be carried over for an additional year from the 2018-2019 reporting year. Considering this number and the final selection list of 2015 ie 1078 now the probability of the success rate is 2 which is less than 1 according to the factual statistics data. Low values for the current ratio values less than 1 indicate that a firm may have difficulty meeting current obligations.

Most common examples of liquidity ratios include current ratio acid test ratio also known as quick ratio cash ratio and working capital ratio. State and District information that can be reported for the current reporting year such as student enrollment graduation rates etc. Since the Great East Japan Earthquake greenhouse gas emissions in Japan had increased until FY 2013 when the largest-ever amount of 14 billion tons was emitted.

Adults 65 years and older was more. If the winding ratio is reversed so that the primary coil has fewer turns than the secondary coil the transformer steps up the voltage from the source level to a higher level at the load. Speed multiplication gear train steps torque down and speed up.

The current ratio and quick ratio are liquidity ratios measuring a companys ability to pay off its short-term liabilities with its short-term assets. Current SLR in India 1800.

/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)

Current Ratio Explained With Formula And Examples

Current Ratio Examples Of Current Ratio With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-02-8806530bcda84b2b9cb3218413e8a417.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

No comments for "Current Ratio Less Than 1"

Post a Comment